Payroll Matching Statement Explaining the Difference

The information the IRS has and what you report on your return is not instantly matched up. Payroll is a necessary workplace function for employees to receive their earned compensation.

Payroll Journal Entry Example Explanation My Accounting Course

A document that details the employees gross wages taxes and deductions.

. Payroll Tax Deductions. Compare Between 10 Best Payroll Services Of 2022. Payroll also refers to the total amount of money employer pays to the employees.

Forms employers must file with tax agencies eg the IRS that summarize employee pay information such as wages and taxes. Both for income tax provisions. An invoice provides more detailed information about a specific sale such as the item description item price shipping charges and sales taxes while a statement only provides a grand total due for each invoice.

Other local taxes can include school district taxes community college taxes state disability or. Local city county income tax withholding in some areas. The first step is to make sure everyone is getting paid the right amount.

Report Inappropriate Content. The Payroll Activity reports gets information from individual pay runs while the Payroll Register reports feed from the pay history in employee cards which can be manually edited resulting a difference between Activity and Register reports. Since youve determined the Payroll Activity report has the correct figures whats remaining is fix.

Review the recommended account category. The quickest explanation for this difference is that the last pay stub and W-2 form will almost always show two different wages. The difference between the two balances may be due to checks issued that have not yet cleared the bank timing differences between your accounting month and the bank statement ending date or errors on either the bank statement.

Ad Looking For Cheap Payroll Services. 1st Basis of Difference. Below you will find some of the most common deduction codes that appear on your pay stub.

When there are timing differences the amount of reported taxable income could vary significantly from the amount reported on the income statement. Salary refers to the amount of pay -- or remuneration -- an employee earns. The income statement is like your childs report.

Box 1 uses the sum of amounts for a long list of tax tracking types like Compensation and 401k. Select the transaction to expand the view. The employee tax rate for Medicare is 145 and the employer tax rate for Medicare.

Use the following steps to reconcile payroll. The two boxes are not calculated in the same way and are not expected to always be the same. Payroll refers to the system employers use to process salary payments.

The employee tax rate for social security is 62. Up to 256 cash back Get the detailed answer. If your 4th Qtr payroll information is going to be filed correctly and that information will match what is on the business tax return you are ready to file.

Find Affordable Payroll Systems for Your Business. Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER which refers to an employers contribution if the employee receives a company match. However this is by no means an exhaustive list.

Along with the amounts that each employee should receive for time worked or tasks performed payroll can also refer to a companys records of payments that were previously. Since the forms are being corrected and filed. As a business function it involves.

FICA Tax Withholding Rates. Add a new transaction. Yes you can still efile.

Over a period of time these timing differences will even out though they may be replaced by a new set of timing differences. Explain the difference between the following four reportspayroll journal payroll register payroll check register andpayroll ta. The employer tax rate for social security is also 62 or 124 total.

Meaning Meaning of Payroll Expenses Payroll expenses represent the total expenses which is paid or to pay to employees in the form of salaries. But it could be that they should be for you. Reconciling your payroll bank account is the process of comparing the general ledger payroll account balance to your bank statement.

Federal income tax Social security taxes Medicare tax withholding State taxes and. Make sure your payroll register accurately reflects wages and hours. The reconciliation of payroll doesnt have to be difficult for small business owners.

Check Our Unbiased Reviews Top Picks. You need to reconcile payroll each pay period before checks actually go out as its much harder to correct any mistakes once people have gotten paid. Invoices are issued whenever a sale has been completed while statements are only issued at set intervals such as at the end of the.

Match each hourly employees time card to the pay register. Payroll is a list of employees who get paid by the company. A balance sheet shows one point in time whereas the income statement shows a companys performance over some time usually a quarter or year.

Examples include Form 941 and Form W-2. Developing organization pay policy including flexible benefits leave encashment policy etc. The payroll register summarizes each employees wages and deductions for the pay period.

Accounting for Income Taxes. The Social Security portion of the tax is capped each year at a maximum wage subject to Social Security. Company will record all these expenses in simple category whose name will be payroll expenses.

Difference on W-2s between federal and state wages. PAYG helps employees divide their tax liabilities into equal payments throughout the year rather than paying all at once. At a high level there are three documents.

When youre done select Match. And the employees net pay. Employer contributions and taxes.

Instead of matching QuickBooks will start a brand new transaction for you using the info from your bank. The main difference is that one is a pre-payment on behalf of your employees and the other is on behalf of your business. Why withhold PAYG on behalf of your employees.

The payroll taxes that must be collected and paid by the employer include. Employees are the service providers and for their services they get the salary. End of the year check stubs will show the total or gross earnings that an employee received whereas a W-2 form is a summary of taxable earnings received in a calendar year.

Notwithstanding the differences between actual pay and process they are also connected. Add means QuickBooks didnt find a matching transaction. Defining payslip components like basic variable pay HRA and LTA.

In treasury management a payroll is the list of employees of some company that is entitled to receive payments as well as other work benefits and the amounts that each should receive. Print out your payroll register.

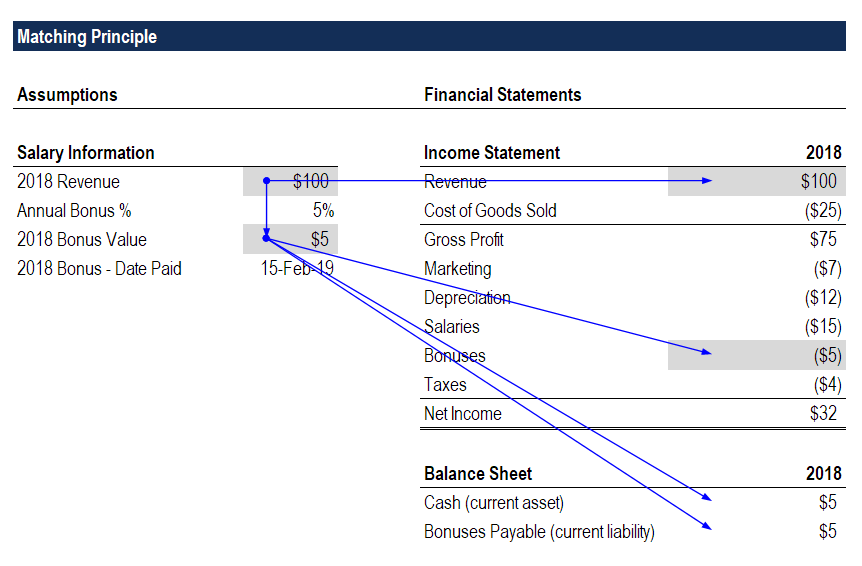

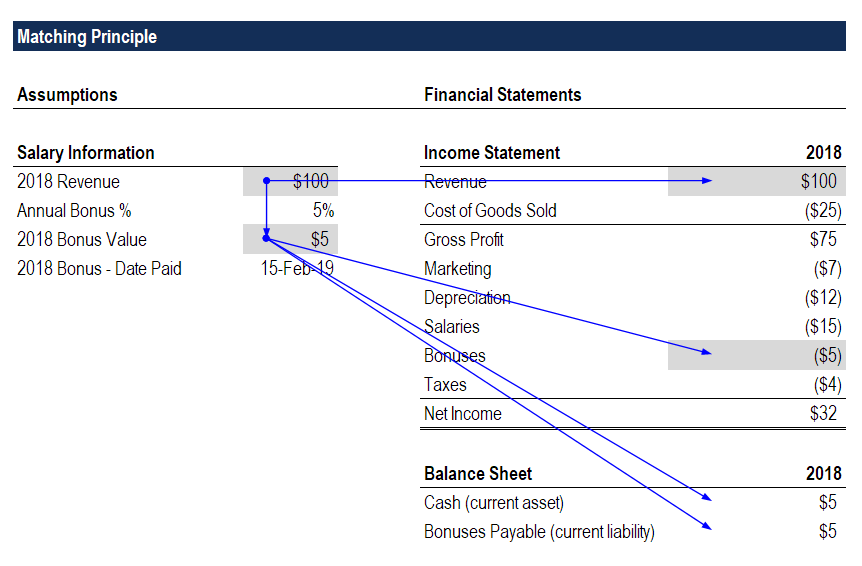

Matching Principle Understanding How Matching Principle Works

Matching Principle Understanding How Matching Principle Works

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

No comments for "Payroll Matching Statement Explaining the Difference"

Post a Comment